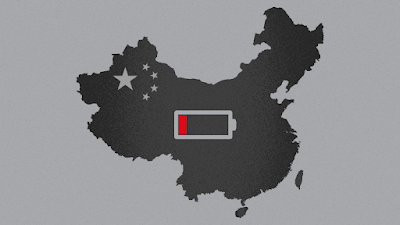

Overview: The poor Chinese March PMI and talk that

the US could tap its strategic oil reserves by as much as one million barrels a

day for six months have rippled through the capital markets. After the

S&P 500 snapped a four-day advance yesterday, equities in the Asia Pacific

region may have been on the defensive today, but sub-50 boom/bust reading in

China took a toll, which only South Korea and India among the large bourses

were able to escape. European markets are softer, while US futures are recovering from

yesterday's losses. US and European 10-year benchmark yields are mostly 3-6 bp lower. The dollar is trading higher against most of the major

currencies. The Scandis and dollar-bloc currencies are bearing the brunt

of the losses, with the Norwegian krone off more than 1.6%. Emerging market

currencies are mixed. Central European currencies are

underperforming. Gold is off around $7 and is in the $1920-$1934 range. Oil, as one

would expect, fell (~6%) on the possibility of a substantial draw down of US

reserves, but May WTI is holding above $100 a barrel, even though earlier this

week it ahead slipped briefly below $98.50. US natgas is off about 1.5%

after gaining 5% yesterday. Europe's natgas benchmark is up about 3.7%

after an almost 9% gain yesterday. It is up more than 20% this

week. Iron ore is a little higher today after rising almost 3.5%

yesterday. Copper is threatening to snap a three-day advance. May

wheat is little changed ahead of the USDA planting update report.

Asia Pacific

China's March manufacturing

PMI fell to 49.5 from 50.2. The non-manufacturing PMI fell to 48.4 from 51.6. Both were

weaker than expected. The composite now stands at 48.8, down from 51.2 in

February. As disappointing as the report was, the situation is worse

because the survey closed a few days before Shanghai was locked down. It

did catch the shuttering of Shenzhen. The weakness of the report fans

expectations for easier monetary policy and other initiatives to support the economy.

A separate report indicated that the issuance of special bonds by the provinces

set a record pace in Q1 (CNY1.25 trillion). The money is thought to help

fund infrastructure spending in Q2.

Japan's February industrial

output rose a meager 0.1%. The median forecast in Bloomberg's survey looked for a 0.5%

gain. This pared the year-over-year gain to 0.2%, not 0.8% that had been

expected. That March Tankan will be released the first thing tomorrow and

is expected to also reflect the deterioration in sentiment. The BOJ's

operations and the decline in US Treasuries helped push the 10-year JGB yield

slightly below 0.21% after briefly poking above 0.25% earlier this week.

The central bank indicated that next quarter it will boost the amount of 1-10-year

bonds it buys. It shaved the amount of 10-25-year bonds will buy at a time

but will increase the number of operations over the quarter. The BOJ's

balance sheet will grow. The BOE has already begun shrinking its balance

sheet. The Bank of Canada indicate it will do the same in a couple of

weeks and the Fed is expected to announce its intention at the net FOMC meeting

in May.

The dollar found support

ahead of JPY121.10, which is the (38.2%) retracement of the rally since March 4

that began from around JPY114.65 and peaked this week slightly above

JPY125.00. The

momentum indicators are rolling over, but we expect a period of

consolidation rather than a trend-reversal. Australia reported a

surge in February building approval (43.5% vs. median forecasts in Bloomberg

survey for 5%, but a volatile series to be sure) and it may build a new port in

Darwin after current facilities had been leased to China. The

Aussie was turned back yesterday after approaching $0.7540, which has

repeatedly capped it in recent sessions. The week's low was a little

below $0.7460. A break would initially target $0.7400 and then, possibly,

$0.7350. The greenback fell to a three-week low against the

Chinese yuan a touch below CNY6.34. The PBOC set the dollar's reference

rate a softer than expected (CNY6.3482 vs. CNY6.3494, according to the

Bloomberg survey). Note that the mainland markets will be closed next Monday

and Tuesday for a national holiday.

Europe

Following the surprisingly

strong Spanish and German March CPI reports, the French reading was

comparatively tame. The

harmonized version rose 1.6% in the month, a tad more than expected. The

year-over-year rate rose to 5.1% from 4.2% and was ironically stronger the

median forecast in Bloomberg's survey for 4.9%. A 25 bln euro measure to

cap electricity and natgas prices, and offer a rebate, reduced measured

inflation by 1.5 percentage points, according to INSEE. Italy was

the only one of the Big Four in the EMU to report lower than expected price

pressures. The harmonized measure rose by 2.6% instead of 2.8% on the

month, and 7.0% instead of 7.2% year-over-year. In February, the year-over-year

rate was 6.2%. The eurozone aggregate figures are due tomorrow.

Separately, France reported

disappointing consumption figures. Consumer spending rose by 0.8% in February. Economists

expected a rise of a little more than 1%. On top of that, the cutback in

January was revised to 2.0% from 1.5%. Note that the first round of the

French presidential election is on April 10. The pattern is for no

candidate to win in the first round, forcing a run-off (April 24) and voters to

unify behind the "establishment" candidate over Le Pen.

After German Chancellor

Scholz talked with Putin yesterday, the conclusion was the Moscow was backing

off of its earlier demand to be paid in roubles for its gas. Meanwhile, some reports indicate that

talks between Ukraine and Russia may resume tomorrow. We continue to

believe Russia will secure military objectives the separatist regions before

negotiating more seriously. Also, some reports indicate that Georgia's

breakaway region in South Ossetia may seek to join Russia. This seems to

be the idea in the separatist regions in Ukraine as well.

The euro initially extended

its recent gains to reach $1.1185, its best level since March 1, before

reversing lower to almost $1.1110. There are two sets of expiring options to note today.

The first is for nearly 2.15 bln euros at $1.12. The other is for 1.55

bln euros at $1.11. Yesterday's low was slightly below $1.1085. Sterling

is sidelined. It is trading quietly in a narrow range

(~$1.3110-$1.3150). It is hovering around unchanged levels (~$1.3130) in

late morning turnover in the UK. If there is to be a range extension in North

America today, we favor the upside, but see the $1.3175-$13200 as the

cap. Lastly, note that the Czech Republic is expected to lift the repo rate

by 50 bp to 5.0% today. The risk may be on the upside.

America

We have argued that Biden

administration has been thinking too small in its previous two efforts to draw

down its Strategic Petroleum Reserves if it wants to have more impact on energy

prices. In November

it announced a 50 mln barrel release and earlier this month, 30 mln

barrels. Surely, these are the conditions that the SPR was created

for. In the past, sometimes, Washington would agree to sell some of the

oil for budgetary purposes. As of March 25, the US stockpile was

estimated at almost 570 mln barrels. Reports suggest that under

consideration is a 180 mln barrel draw over six months, or about 1 mln barrels

a day. Ideally, it would be a coordinated effort with other

countries. As we noted yesterday,

there is strong correlation between the change in oil prices and the change in

inflation expectations as expressed through the 10-year breakeven rates.

OPEC+ meet today and are unlikely to boost their output. On the other

hand, some reports suggest that Washington may allow a US-based oil company to

speak directly with the Maduro government in Venezuela, to ostensibly prepare

for a lighter sanction regime, which officials deny is currently under

consideration.

Ahead of tomorrow's jobs

report, the US reports February income, consumption, and deflators. Personal income and consumption are

expected to have risen by 0.5%. Income is lagging behind inflation, and

he real drop in income may cap consumption. The headline deflator, which

the Fed targets is forecast to rise by about 0.6% to lift the year-over-year

rate to 6.4% from 6.1%. The core measure, which gets plenty of airplay

but is not targeted, is expected to rise to 5.5% from 5.2%. Although the

Fed does not target the CPI measure, its earlier release steals the thunder from

the PCE deflators. The weekly jobless claims fell to a new low since 1969

last week. A small tick up that is expected today will not change views

of the strength of the US labor market. The median forecast in Bloomberg's

survey sees March nonfarm payrolls rising by 490k.

Canada reports January

GDP. A 0.2%

gain is expected after a flat December. The report is too old to have

much market impact. Earlier this week, the swaps market appeared to have

a 50 bp hike fully discounted for the April 14 Bank of Canada meeting. It

has slipped to about a 66% chance now. Mexico reports worker remittance

tomorrow, which has been a surprisingly strong source of hard currency.

Later today, Colombia is expected to hike its overnight lending rate by 150 bp

to 5.50%. Consumer inflation is running a little north of 8%. It last

hiked by 100 bp in January. The swaps market has about 500 bp of

tightening priced over the next six months.

The Canadian dollar and

Mexican peso recorded new 2022 highs yesterday. The peso made a marginal new high

today, but both are a bit better offered now. The US dollar is at a new

three-day high against the Canadian dollar near CAD1.2530. There may be

some resistance in the CAD1.2555 area, but the potential may extend toward CAD1.2580-CAD1.2600,

if not today, then tomorrow. Recall that the peso began

this week with an 11-session rally in tow, the longest in half a century. Even

with the small loss today, it is gains 13 of the past 15 sessions. The

MXN20.00 area, which previously offer the greenback support now may serve as

resistance.

Disclaimer

Reviewed by Marc Chandler

on

March 31, 2022

Rating:

Reviewed by Marc Chandler

on

March 31, 2022

Rating: